A Personal Perspective and Pan-European Opportunity

I had the privilege of keynoting the second day and moderating a pivotal panel at the Bayern Innovative Next Generation Manufacturing conference in Munich. The discussion centered on "A Manifesto for a Competitive European Additive Manufacturing Sector," providing insights into Europe's AM ecosystem challenges and opportunities.

Europe, particularly Germany, leads in AM technology innovation. However, this technological advantage hasn't consistently translated into rapid adoption or industrial competitiveness compared to the United States and China. European leaders need to leverage global perspectives to shape AM's future direction.

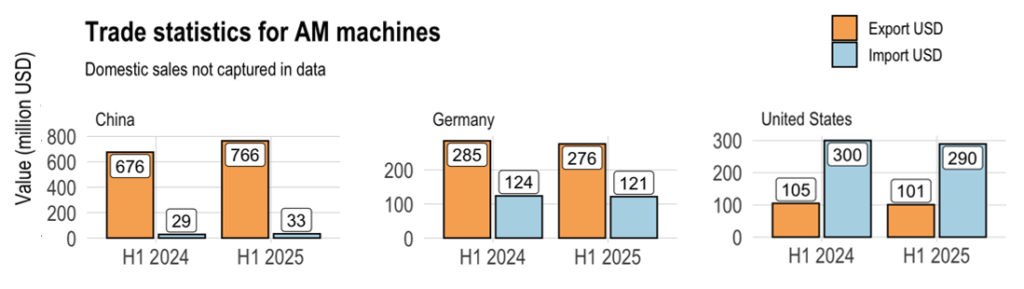

The State of Global AM Equipment Trade

Analysis of AM machine exports during the first half of 2024 and 2025 reveals significant disparities among major players:

China's Dominance: China's AM machine exports averaged approximately $700 million in the first half of each year, ranging between $676 million and $766 million. This represents 2.5 to 6 times larger export volumes than Germany and the US respectively.

Growth Trajectories: China experienced roughly 13% year-over-year growth in AM machine exports during the first half of 2025, while Germany and the United States remained largely flat during the same period.

Market Implications: China operates at significantly higher scale while continuing expansion, widening its lead in global AM manufacturing capacity and production capabilities.

Landscape: Innovation Hubs, Collaboration, and Bottlenecks

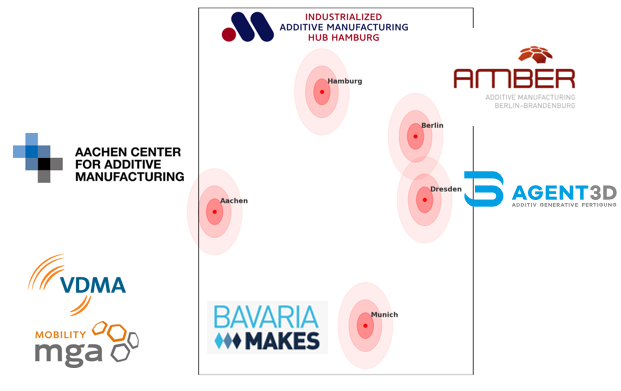

Germany hosts multiple advanced manufacturing centers including AMBER (Berlin), AGENT3D (Dresden), Bavaria Makes (Munich), Industrialized Additive Manufacturing Hub Hamburg, Aachen Center for Additive Manufacturing, VDMA Additive Manufacturing, and Mobility Goes Additive partnerships.

Despite thriving research networks and leadership, industry participants consistently emphasized a critical gap: "We can innovate, but implementing and industrializing AM at scale remains a challenge."

The "Germany Makes" Initiative: Participants suggested that a coordinated public-private partnership modeled after America Makes could accelerate technological development and industrial adoption at scale. Currently, "Germany Makes" exists only as an informal alliance of five key regional hubs: Aachen, Berlin, Dresden, Hamburg, and Munich.

EU-Wide Coordination: Conference attendees questioned whether national-level German collaboration suffices, highlighting the necessity for meaningful integration across European Union member states. They emphasized that unified EU initiatives like AM-Europe represent the appropriate scale for coordinated policy, academia, and market intelligence integration.

Panel Highlights: Manifesto for a Competitive European AM Sector

The moderated panel featured Filip Geerts (CECIMO), Alexander Jakschik (ULT AG/VDMA), and Dr. Adriaan B. Spierings (Swissmem). The discussion focused on converting Europe's R&D dominance into industrial competitiveness.

Three Core Imperatives:

-

Unified Strategy: Europe must connect innovation, scalable adoption, and policy frameworks for AM growth.

-

Ecosystem Collaboration: The AM-Europe manifesto, endorsed by over 10 national associations, calls for central public-private partnerships, strategic investment, and alignment of standards and educational programs.

-

Urgency for Competitiveness: Participants advocated for speed, collaboration, and scale to transform Europe's technological advantages into market performance.

Government Support: Examples from the U.S. and Lessons for Europe

Germany's 2025 Coalition Agreement references additive manufacturing but currently lacks dedicated industrial deployment funding. Conversely, coordinated US government and defense initiatives offer strategic support models.

US Policy Examples:

Department of Defense mandates prioritize advanced manufacturing, rapid prototyping, and industrial base sustainability. AM Forward, catalyzed by Astro America, brings together public and private partners enabling defense suppliers to adopt AM for arsenal deployments and ship repairs in remote locations.

European Implications: Robust, well-coordinated government support paired with collaborative networks proves fundamental for translating innovation into competitive adoption and industrial resilience.

Conclusion: Speed, Talent, Vision, and the Need for Scale

Europe possesses requisite talent, technology, and connectivity for AM leadership. The missing elements are coordination, speed, and funding—requiring action beyond intentions.

Collaborative networks, pan-European initiatives, and expanded public-private funding can transform research into competitive real-world success.

The path forward depends on European vision and decisiveness. International evidence demonstrates that global AM competitiveness requires collaboration and dedicated investment, positioning Europe to shape advanced manufacturing's future.

Evolving Wohlers Associates

Wohlers Associates is building a dynamic, next-generation intelligence ecosystem:

- Market Intelligence Platform: An interactive portal currently in closed beta, launching Q1 2026

- Custom Data Analysis: Tailored market figures and forecasts for specific needs

- Targeted Advisory Services: Specialized consulting for AM business challenges

Participate in the Wohlers Report 2026 Survey: Help shape the next edition by sharing your insights at our WR2026 Survey.

For more information, contact us at wa@wohlersassociates.com.